|

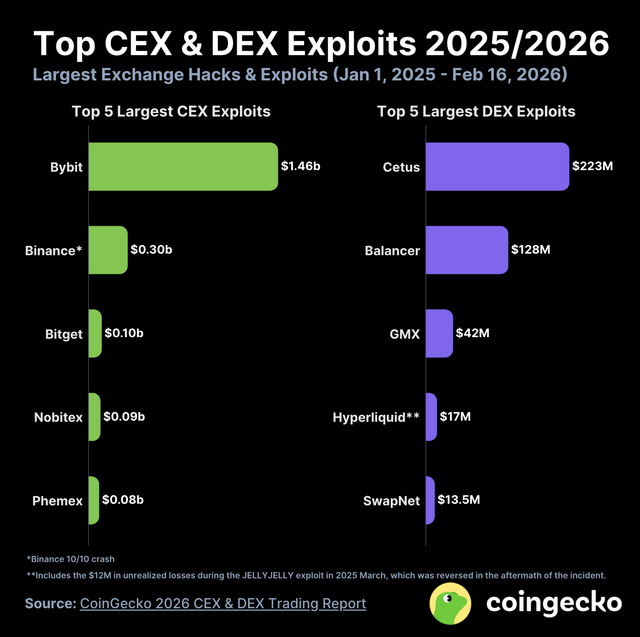

Here’s a breakdown of the largest exchange exploits from January 2025 to February 2026. On the CEX side, losses exceeded $2.0 billion. The Bybit hack in February 2025 alone accounted for $1.46 billion. That’s 71% of total CEX losses. The remaining top 5 CEX exploits were Binance ($300M, linked to the October 10 crash), Bitget ($100M), Nobitex ($90M), and Phemex ($80M). The most common point of failure? Compromised private keys, with 3 of the top 5 hacks originating from social engineering and UI-phishing attacks. DEX exploits were significantly smaller in comparison. Cetus led at $223M, followed by Balancer ($128M), GMX ($42M), Hyperliquid ($17M), and SwapNet ($13.5M). The primary attack vector for DEXs was smart contract vulnerabilities. Where do you mostly store your capital? Source: https://www.coingecko.com/research/publications/cex-dex-trading-activity-report-2026 submitted by /u/khai0001 |

In the crypto landscape, stablecoin depegging often causes alarm, but this is frequently misinterpreted. Cain O’Sullivan of Hyperdrive explains that price drops can stem from liquidity issues rather than failures in the underlying reserves. The New Money Market ‘Meta’: Redemption over Oracles In the world of decentralized finance ( DeFi)—and the broader crypto economy—reports of […]

In the crypto landscape, stablecoin depegging often causes alarm, but this is frequently misinterpreted. Cain O’Sullivan of Hyperdrive explains that price drops can stem from liquidity issues rather than failures in the underlying reserves. The New Money Market ‘Meta’: Redemption over Oracles In the world of decentralized finance ( DeFi)—and the broader crypto economy—reports of […]

Digital asset platform Nexo officially launches in Argentina following its acquisition of Buenbit to offer high-yield savings and crypto-backed credit. Global digital asset wealth platform Nexo established its regional hub in Buenos Aires on March 5, 2026. The expansion introduces a digital dollar savings alternative allowing local users to earn up to 13% annual interest […]

Digital asset platform Nexo officially launches in Argentina following its acquisition of Buenbit to offer high-yield savings and crypto-backed credit. Global digital asset wealth platform Nexo established its regional hub in Buenos Aires on March 5, 2026. The expansion introduces a digital dollar savings alternative allowing local users to earn up to 13% annual interest […]

According to Netblocks, an internet observatory, the regime disrupted 99% of the country’s connectivity to the internet just hours after the first strikes hit Iran. These measures, which have been implemented by the Iranian regime before, impact the economic activities and communication capabilities of civilians. Iran Registers Over 168 Hours With a Near-Total Internet Blackout […]

According to Netblocks, an internet observatory, the regime disrupted 99% of the country’s connectivity to the internet just hours after the first strikes hit Iran. These measures, which have been implemented by the Iranian regime before, impact the economic activities and communication capabilities of civilians. Iran Registers Over 168 Hours With a Near-Total Internet Blackout […]

Tether announces a strategic investment in fintech innovator Axiym to integrate USDT into regulated treasury and settlement infrastructures. Tether, the largest stablecoin issuer in the world, announced a strategic investment in Axiym on 5 March 2026. This partnership focuses on embedding USDT directly into Axiym’s distributed treasury and settlement infrastructure to enhance global financial access. […]

Tether announces a strategic investment in fintech innovator Axiym to integrate USDT into regulated treasury and settlement infrastructures. Tether, the largest stablecoin issuer in the world, announced a strategic investment in Axiym on 5 March 2026. This partnership focuses on embedding USDT directly into Axiym’s distributed treasury and settlement infrastructure to enhance global financial access. […]